The rise of artificial intelligence (AI) is driving an unprecedented surge in demand for data centers. This article will explore the growing need for AI data centers, the challenges they face, and the opportunities they present.

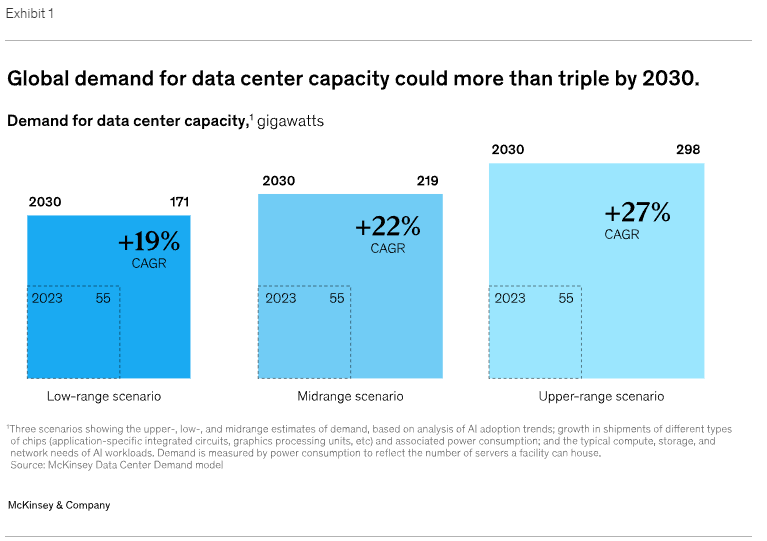

The demand for data centers has been increasing for years due to the growing reliance on data in modern life. However, the emergence of AI, and specifically generative AI, is pushing this demand even higher, likely leading to a supply deficit. This surge is primarily driven by the computational power needed to run AI workloads. McKinsey predicts that global demand for data center capacity could increase at an annual rate of 19-22%, reaching 171-219 gigawatts (GW) by 2030.

In a more extreme scenario, demand could rise by 27%, reaching 298 GW.3 The current demand is 60 GW, indicating a potential need to build more than double the data center capacity constructed since 2000 in less than a quarter of the time.

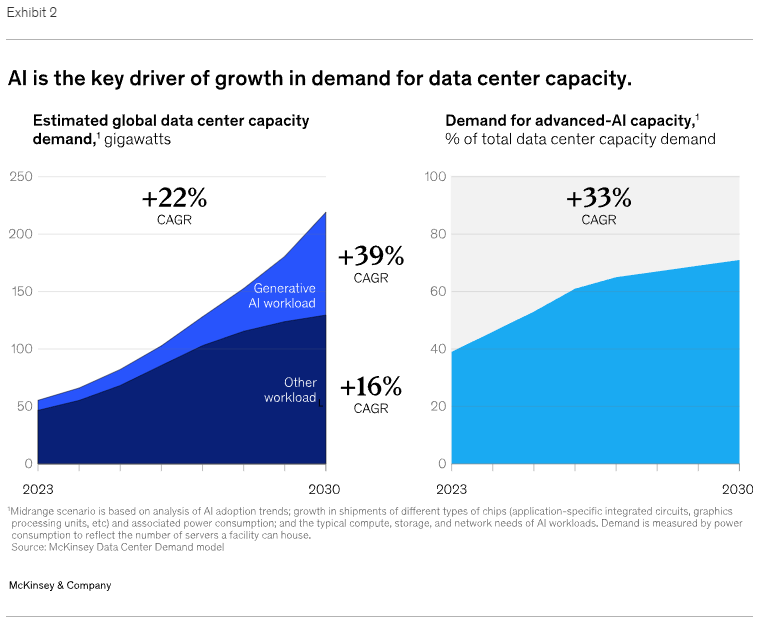

Meeting this demand for AI-ready capacity is crucial, as it involves providing the high computational power and power density required for AI workloads. By 2030, approximately 70% of the total demand for data center capacity will be for centers equipped to handle advanced AI workloads. Generative AI, the fastest-growing AI use case, will account for around 40% of this total demand.

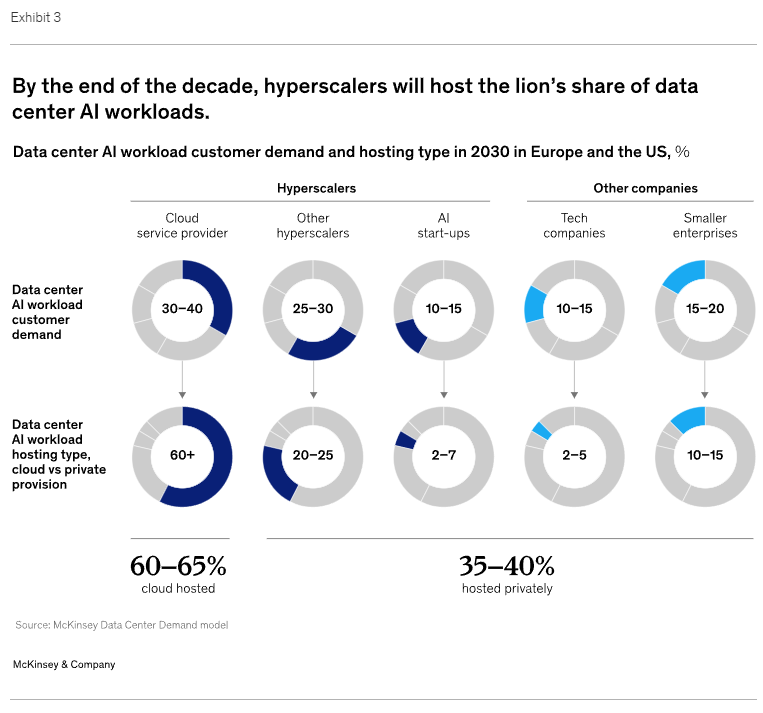

Cloud service providers (CSPs), such as Amazon Web Services, Google Cloud, Microsoft Azure, and Baidu, are the primary drivers of the increasing demand for AI-ready data centers. This is due to the capacity they require to run large foundational models they develop themselves or to host models developed by AI companies. While most companies currently use off-the-shelf AI models hosted on public clouds, this is expected to change as AI technology matures. More enterprises are likely to build and train their own models using their internal data, potentially leading to an increase in demand for private hosting. However, by 2030, it is estimated that 60-65% of AI workloads in Europe and the United States will still be hosted on CSP and other hyperscaler infrastructures.

To meet the rising demand, CSPs, who currently own over half of the world’s AI-ready data center capacity, are rapidly building state-of-the-art facilities. Due to impending supply constraints, they are also partnering with colocation providers (colos), who are similarly expanding their infrastructures. Additionally, a new group of GPU cloud providers is emerging to meet the demand for AI-ready data center capacity by offering high-performance GPUs as a service.

However, this new capacity may not keep pace with demand, as indicated by a tight supply in the market.7 Prices for available data center capacity in the US have increased by an average of 35% between 2020 and 2023, after steadily falling from 2014 to 2020. Additionally, new capacity expected to come online in the next 2-3 years has already been leased out. In Northern Virginia, known as the data capital of the world, the vacancy rate was less than 1% in 2024.7 High demand is causing supply constraints for power, key electrical infrastructure components, and labor, further delaying the completion of new facilities.

The need for AI-ready data centers is bringing about significant changes in their construction, specifically in terms of location, power infrastructure, mechanical systems, and electrical systems.

Location and Power Infrastructure

The increasing power requirements of data centers, driven by the high energy consumption of AI servers, are causing power supply issues in traditional data center hubs. This is leading to a shift in data center locations. Data centers dedicated to training AI models, which have less stringent latency requirements, are being built in more remote locations in the US, such as Indiana, Iowa, and Wyoming, where power is more abundant and grids are less strained.

To overcome power supply challenges, some data center operators are acquiring facilities close to power plants and exploring off-grid power generation using fuel cells, batteries, or renewables. Small modular reactors (SMRs) might be a future option for data centers.

Mechanical and Electrical System Design

Traditional air-based cooling systems are struggling to cope with the high power densities of AI servers.Liquid cooling systems are becoming more popular due to their higher efficiency in heat absorption and transfer. Different liquid cooling technologies are available, including rear-door heat exchangers, direct-to-chip technology, and liquid immersion cooling, each with varying applications and levels of integration with existing data center infrastructure.

AI workloads also necessitate changes in electrical system design. Data center operators are installing larger power distribution units, switchgear, and floor-mounted power distribution units to handle higher power densities. Additionally, there is a shift towards 48-volt power supply units at the rack level to reduce energy loss and improve system efficiency. Backup systems are also being reassessed, with some AI-focused data centers opting for lower power redundancies for training workloads, which are considered less critical compared to business operations.

Opportunities and Future Outlook

The rapid growth of AI and the corresponding demand for data centers present numerous opportunities for companies and investors across the value chain. Data center owners and operators can capitalize on the demand by retrofitting existing data centers and building new ones, particularly to lease capacity to hyperscalers. Construction companies and equipment suppliers can benefit from the increased need for modular construction and various mechanical and electrical equipment.17 Additionally, players in the energy and power supply value chain can seize opportunities by generating and distributing more energy, developing on-site sustainable power solutions, or promoting heat reuse from data centers.

To succeed in this evolving market, companies and investors may need to adopt new approaches, including moving more quickly, collaborating more, and investing more. The fast pace of change requires swift action in securing sites, innovating cooling systems, and scaling up capacity.18 Collaboration within the value chain and with other sectors can accelerate innovation and address capacity constraints. Significant investment is also needed to scale data center infrastructure, estimated to require over a trillion dollars across the ecosystem.

AI data centers are not just facilities for storing and processing information; they are crucial enablers of technological advancement.19 Organizations that invest in advanced infrastructure and energy solutions will be well-positioned to benefit from this evolving landscape.19 The success in this new paradigm will be defined by intelligent AI and energy management, along with strategic investments.

Sources:

- AI Data Centers And The New Era Of Unprecedented Demand, Forbes1234…

- AI power: Expanding data center capacity to meet growing demand | McKinsey